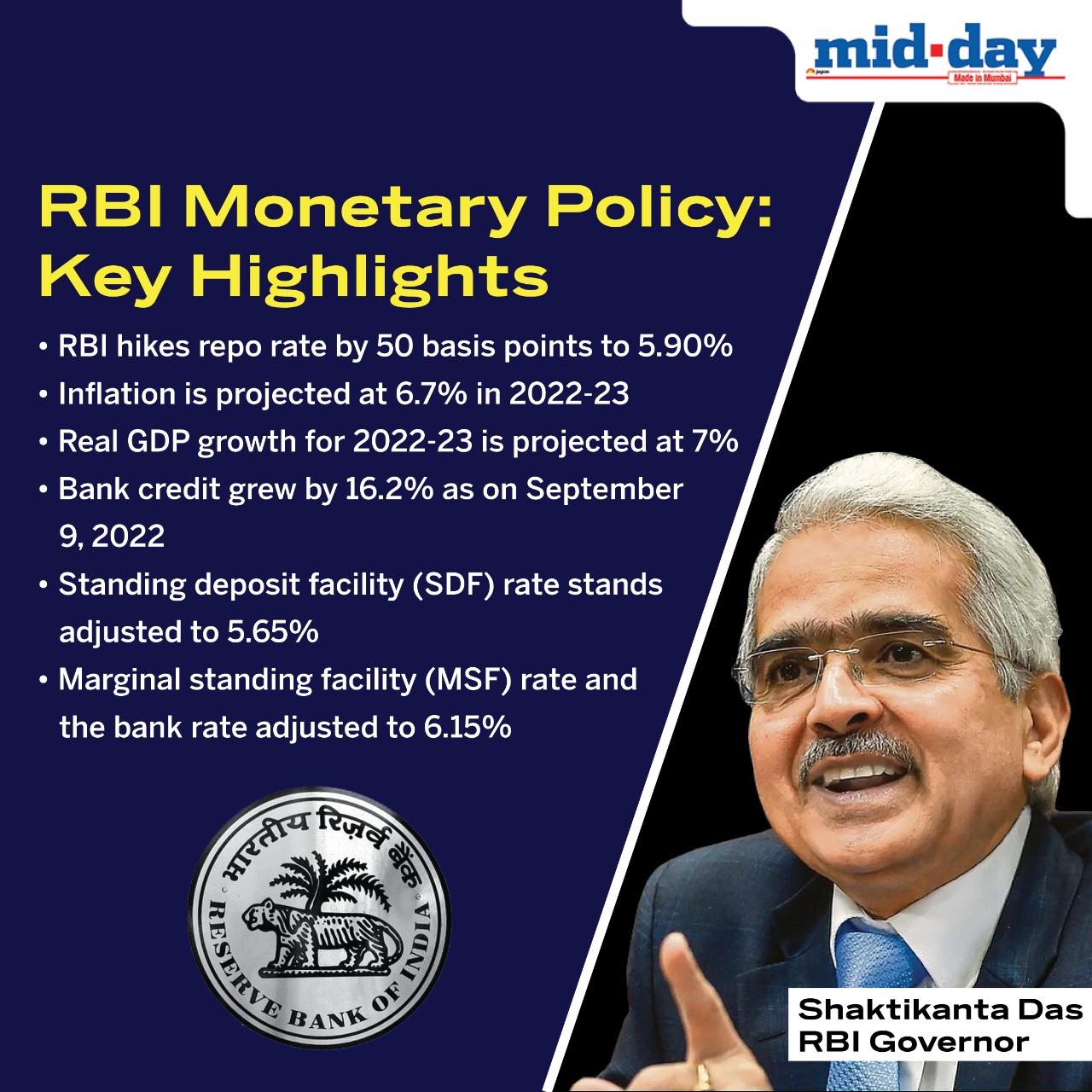

The Monetary Policy Committee (MPC), comprising three members from the RBI and three external experts, raised the key lending rate or the repo rate to 5.90 per cent

HDFC Bank. File Pic

Mortgage lender HDFC Ltd on Friday hiked its lending rate by 50 basis points hours after the Reserve Bank of India (RBI) raised the benchmark interest rate to tame inflation.

ADVERTISEMENT

The move would increase EMIs for housing loans by the firm.

"HDFC increases its Retail Prime Lending Rate (RPLR) on Housing loans, on which its Adjustable Rate Home Loans (ARHL) are benchmarked, by 50 basis points, with effect from October 1, 2022," the country's biggest housing finance company said in a statement.

This is the seventh rate increase undertaken by HDFC in the last five months.

Also Read: RBI cuts growth forecast to 7 per cent for current fiscal

Other financial institutions and banks are also expected to follow suit after the RBI on Friday raised the key interest rate by 50 basis points, the fourth straight increase since May.

The Monetary Policy Committee (MPC), comprising three members from the RBI and three external experts, raised the key lending rate or the repo rate to 5.90 per cent -- the highest since April 2019 -- with five out of the six members voting in favour of the hike.

Since the first unscheduled mid-meeting hike in May, the cumulative increase in interest rate now stands at 190 basis points and mirrors similar aggressive monetary tightening in major economies around the globe to contain runaway inflation by dampening demand.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!