Remittix’s PayFi solution streamlines this transaction, converting crypto to fiat with almost instantaneous speed, lowering fees and removing uncertainty.

PEPE price prediction

PEPE and Ethereum are both drawing the interest of crypto enthusiasts, but for two entirely different reasons. PEPE price prediction is negative and Ethereum is burdened with a multi-month downtrendwith enthusiasts wondering if they have any long-term use.

ADVERTISEMENT

In spite of the gloom, most investors are always on the lookout for the next big thing and this has seen new arguments arise about which altcoin has the potential to bring 100x returns.

Sentiment in the market today is compelling some owners to rethink, particularly with larger coins faltering. In the midst of the storm, there is a new competitor in the mix and the implication is that success in crypto may be less dependent on being simply on memes or reputation.

PEPE’s Steep Slide: From Meme Coin Highs to Bearish Pressures

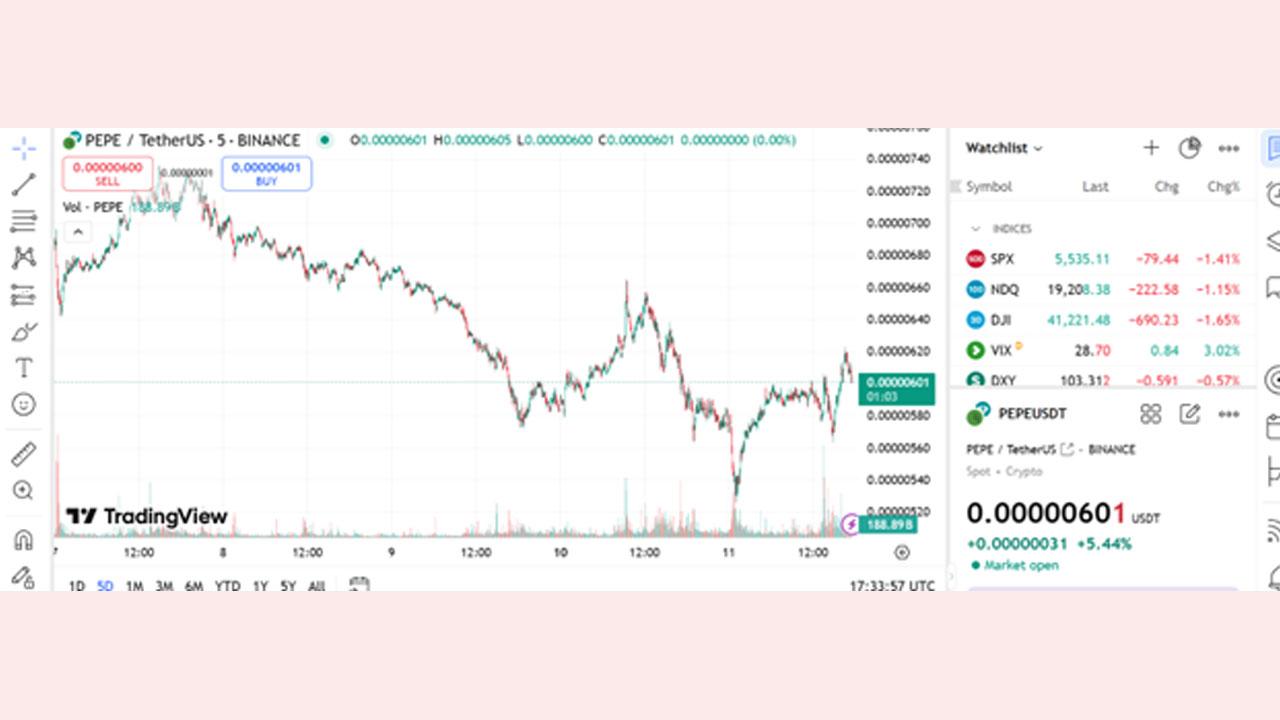

Currently priced at around 0.000006, the Frog-based digital asset PEPE fell around 79% from an all-time high. Following the appearance of a death cross pattern, the token reached a low not seen in months. The 24-hour price chart indicates a decline by another 8.65%, quoting ongoing bearishness.

Some analysts giving PEPE price predictions propose a reversal is still in the pipeline if PEPE manages to hold above $0.0000050. The Relative Strength Index indicates oversold conditions, yet momentum is questionable. In the meantime, the negative sentiment and high liquidation levels in the general market contribute to the pressure with PEPE racing against time to recuperate.

Source: Tradingview

Ethereum’s Prolonged Downturn: Tariffs, High Fees and Fading Developer Interest

Ethereum, once a top pick for countless DeFi projects, has been slipping for nearly three months. It hit an all-time high of more than $4,100 in December 2024 but has lost more than 53% since then. Experts attribute problems like U.S. tariffs, as well as the absence of recent developments in the network, to have started impacting.

Analysts note that ETH needs to reclaim key support at around $1,800 to turn bullish once more. In the meantime, outflows from Ether ETF indicate institutional support may be drying up. Some large players envision the possibility of Ethereum trending upward again, but for the time being, it remains under the cloud of macro fears and exorbitant network fees scaring off new builders.

Source: Tradingview

Remittix (RTX) Gains Momentum with Unique PayFi Approach

While PEPE’s price prediction is not looking promising and ETH also grapples with negative trends, another altcoin has quietly built a case for massive growth. At $0.0734 and having raised more than $13.8 million in presale, Remittix has already sold more than 518 million tokens.

Rather than riding the coattails of meme culture or name recognition of legacy brands, Remittix solves crypto’s real pain point: simple, cross-border transactions.

Take the example of a textile business with international distribution, sending goods to customers worldwide. Conventional money transfers are slow and expensive, frustrating for the business and its customers.

Remittix’s PayFi solution streamlines this transaction, converting crypto to fiat with almost instantaneous speed, lowering fees and removing uncertainty. Experts believe tokens with practical uses can attract more users, even those fed up with price volatility based on hype.

Part of Remittix's appeal is that it can provide freelancers and companies stable payments over the excitement of speculative highs. Its supporters think that a stable use case has long-term worth, creating a trajectory that can lead it to overtake others when mania in markets subsides.

While there are Ethereum holders who are ETH die-hards and PEPE price prediction not looking promising, others see Remittix’s approach as a fresh contender for outsized gains.

Hunting for the Next 100x: Why Utility-Driven Tokens May Outshine Meme Culture

PEPE’s struggle highlights how meme coins can skyrocket then crash, while Ethereum's decline illustrates that even top networks are not exempt from macroeconomic forces. Amidst such challenges, a use case altcoin is most prominent for 100x vision holders. Utility tokens like RTX can thrive irrespective of the market decline if they solve intrinsic pain points like slow remittances.

Remittix's rise suggests that substance over spectacle could be the secret to crypto success in the future. If PEPE does not bounce back or ETH's decline continues, a PayFi initiative would be a welcome respite for traders. As the days pass, meeting real-world needs could be more than short-term hype, giving Remittix a shot at eclipsing its meme-based and legacy rivals.

Eager to explore a token that prioritizes real-world usefulness?

Check out Remittix and see how a PayFi-centric model could offer more stable, long-term growth even as the market chases the next big 100x opportunity.

Disclaimer:The information provided on the Website does not constitute investment advice, financial advice, trading advice, or any other form of advice, and you should not interpret any of the Website's content as such. Midday does not recommend that you buy, sell, or hold any cryptocurrency. Please conduct your own due diligence and consult with a financial advisor before making any investment decisions. Midday does not endorse or promote any such activities, and you access them at your own risk, fully understanding the monetary and legal consequences involved. Midday shall not be held responsible for any losses you may incur as a result of using any such apps or websites. Cryptocurrency products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for losses resulting from such transactions.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!