Govt proposes motor vehicle tax at 6 per cent for electric vehicles that cost more than R30 lakh

Motor vehicle tax is proposed to be capped at R30 lakh from the earlier Rs 20 lakh. Representation pic/iStock

Citizens buying CNG/LPG cars and EVs costing more than Rs 30 lakh will have to shell out more in tax. In its budget presented on Monday, the state government proposed a motor vehicle tax at the rate of 6 per cent on electric vehicles priced above R30 lakh. It has also proposed an increase in tax on individual owned non-transport four-wheeler CNG and PNG vehicles by 1 per cent. At present, the tax ranges between 7 and 9 per cent.

ADVERTISEMENT

Also, motor vehicle tax is proposed to be capped at R30 lakh from the earlier Rs 20 lakh.

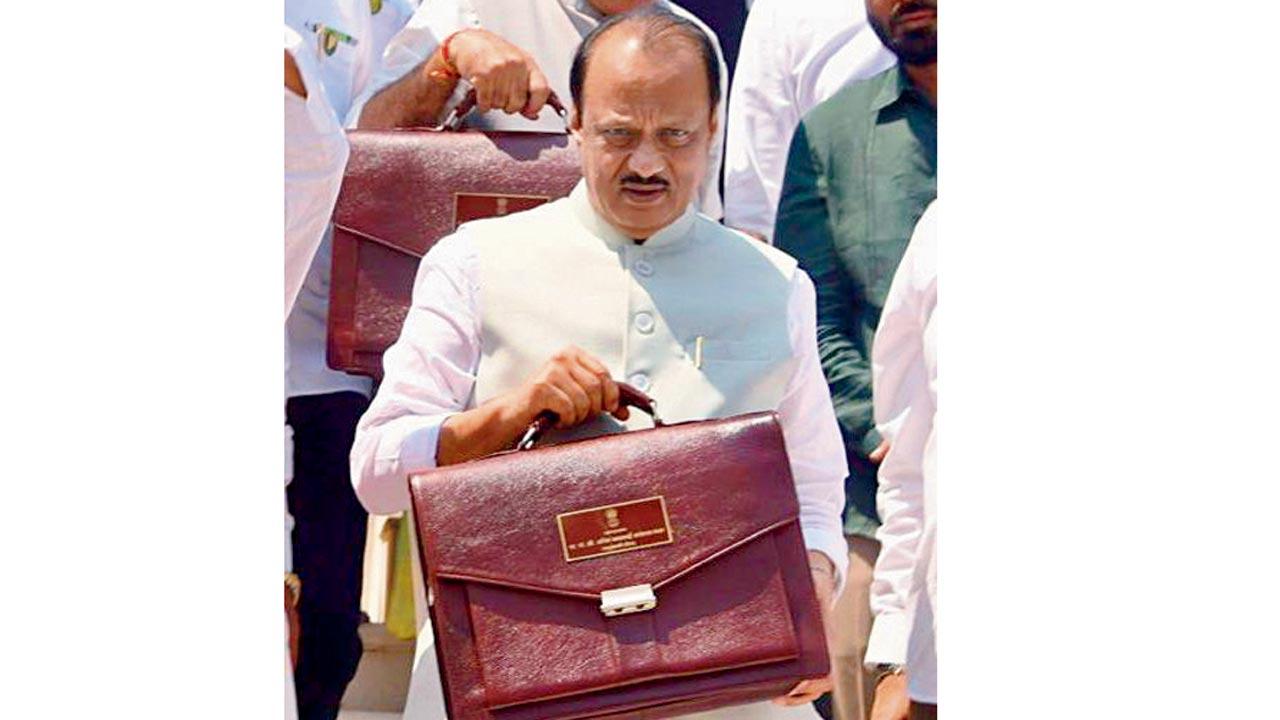

Ajit Pawar, state finance minister

Ajit Pawar, state finance minister

State Finance Minister, Ajit Pawar said, “With the proposed increase in motor vehicle tax, the state is expected to generate additional revenue to bridge the receipt and expenditure gap.” Pawar stated that the government had justified these tax revisions as a necessary step to boost revenue and fund infrastructure projects. “The additional income will be used for road development, urban transport improvements and environment sustainability initiatives,” Pawar added.

In 2024-25, the state collected Rs 14,875 crore in motor vehicle tax. This fiscal (2025-26) the state is expected to collect Rs 15,606 crore.

Other hikes:

. Tax on construction vehicles: A 7% lump sum tax to be imposed on vehicles used for construction—cranes, compressors, projectors, and excavators. (Expected added revenue: Rs 180 crore)

. Tax on Light Goods Vehicles (LGVs): A 7% lump sum tax will be imposed on LGVs carrying goods up to 7,500 kg. (Expected added revenue: Rs 625 crore)

. Stamp duty hike on supplementary documents from R100 to R500, when multiple documents are used to complete a single transaction.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!