Volatility calls for a cautious approach, especially at higher levels

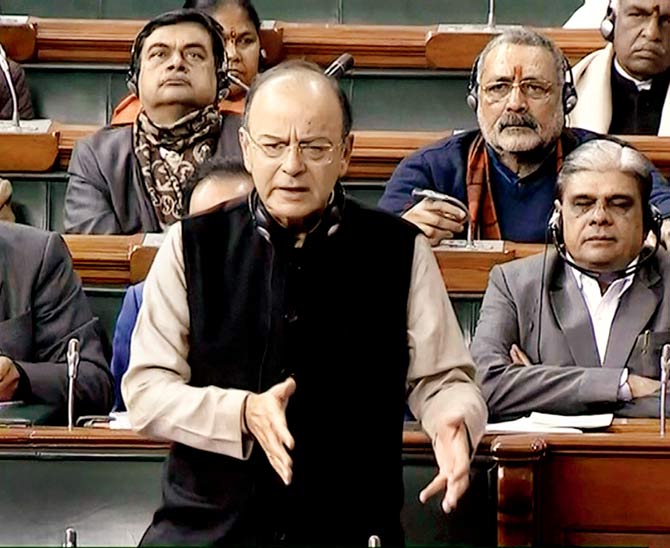

Finance Minister Arun Jaitley speaks on the last day of Parliament winter session in New Delhi on Friday. Pic/PTI

ADVERTISEMENT

The New Year began on a not so promising note for the markets with them being under pressure for the first three days. However, trading on Thursday and Friday swung the mood and helped markets recover lost ground and post gains for the opening week of calendar year 2018. The BSESENSEX gained 97.02 points or 0.28 per cent to close at 34,153.85 points. NIFTY gained 28.15 points or 0.27 per cent to close at 10,558.85 points. The broader markets saw the BSE100, BSE200 and BSE500 gain 0.58 per cent, 0.70 per cent and 0.89 per cent respectively. BSEMIDCAP gained 1.37 per cent while BSESMALLCAP gained 2.41 per cent.

Gains reign

The top sectoral gainer was BSEMETAL up 4.54 per cent followed by BSECONDUR 4.45 per cent and BSECAPGOOD 3.78 per cent. The top loser was BSEOIL&GAS down 0.76 per cent followed by an identical 0.76 per cent in BSEAUTO and BSEIT down 0.73 per cent. In individual stocks, the top gainer was Tata Power up 5.77 per cent followed by Coal India 5.65 per cent and Yes Bank 5.40 per cent. The top loser was BPCL down 6.40 per cent followed by Eicher Motors 3.56 per cent and Maruti 3.15 per cent.

Going strong

The Indian Rupee continued its strong showing and was up Rs 63.37 to the US Dollar. Dow Jones was on a roll and gained 576.65 points or 2.28 per cent to close at 25,295.87 points. Dow Jones is also making new record life times highs continuously. Gains of this kind have not been seen on the Dow for a long time.

Issue eye

Primary markets had a great time last year and one saw record fund raising happening in terms of amount raised and the number of issues to hit the market. Further, the SME segment has seen unimagined traction and has fared even better than the main board in terms of offerings during the year. By and large for every issue on the main board the SME has seen double the number of issues.

Kicking off

The first issue on the main board kicks off in the week with Apollo Micro Systems Limited tapping the capital markets with its fresh issue to raise Rs 156 crore in a price band of Rs 270-275. There is a discount of Rs 12 for eligible employees and retail investors. The company is an electronic, electro-mechanical, engineering design, manufacturing and supplies company. It designs and develops high performance, mission and time critical solutions for defence, space and home and security. It would be appropriate to state that the company is a critical mid-size 'Make in India' for defence applications. The issue is being offered at a price-earnings multiple of 19.94 to 20.31 times. The business is working capital intensive and the major object of the issue is raising funds for working capital. The issue opens on Wednesday, January 10 and closes on Friday, January 13.

Movement microscope

Valuations continue to increase at a much faster pace than one would ever expect. The markets are certainly very expensive but excess liquidity is not permitting the correction to happen. Every dip is a buying opportunity and investors taking that cue are being rewarded by the market movement. To add fuel to the fire is the fact that global markets have also had a great year and the Dow is leading from the front. Is there therefore any cause for worry?

Damage control

There are a couple of factors which could cause serious damage to the ongoing rally. The first is the run up in crude oil prices, which is now at a crucial level. Any further increase from here could hurt India quite badly and impact our economy and therefore our markets adversely. Second, the GDP numbers announced last Friday are not to encouraging and indicate that proactive steps to kickstart the economy may be announced in the budget.

Tightrope time

The country goes to its general elections in April-May 2019 which is now 15 months away. The budget to be announced on February 1 is the last full budget for the government of the day. Keeping this in mind where they must walk the tightrope keeping the fiscal deficit in check, and simultaneously ensuring that the economy needs to be given a boost and the electorate won over, may be the proverbial last straw on the camel's back.

Caution cues

The last two days movement in the markets have given a fresh impetus to the markets, and the rally which is currently on. This augurs well for the bulls and they have the momentum on their side. Markets would be volatile with a positive bias in the coming week. Investors would be well advised to be cautious at higher levels.

Arun Kejriwal is founder of the Mumbai-based advisory firm Kejriwal Research & Investment Services Pvt Ltd.

Disclaimer: No financial information whatsoever published anywhere in this newspaper should be construed as an offer to buy or sell securities, or as advice to do so in any way whatsoever. All matter published here is for educational and information purposes only.

Download the new mid-day Android and iOS apps to get updates on all the latest and trending stories on the go

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!