Parents of children with SMA say customs duty waivers have existed for years, offering no real financial relief; the custom duty exemption has existed for years, offering no real relief. The drugs are so expensive, costing crores, that only a few can afford them

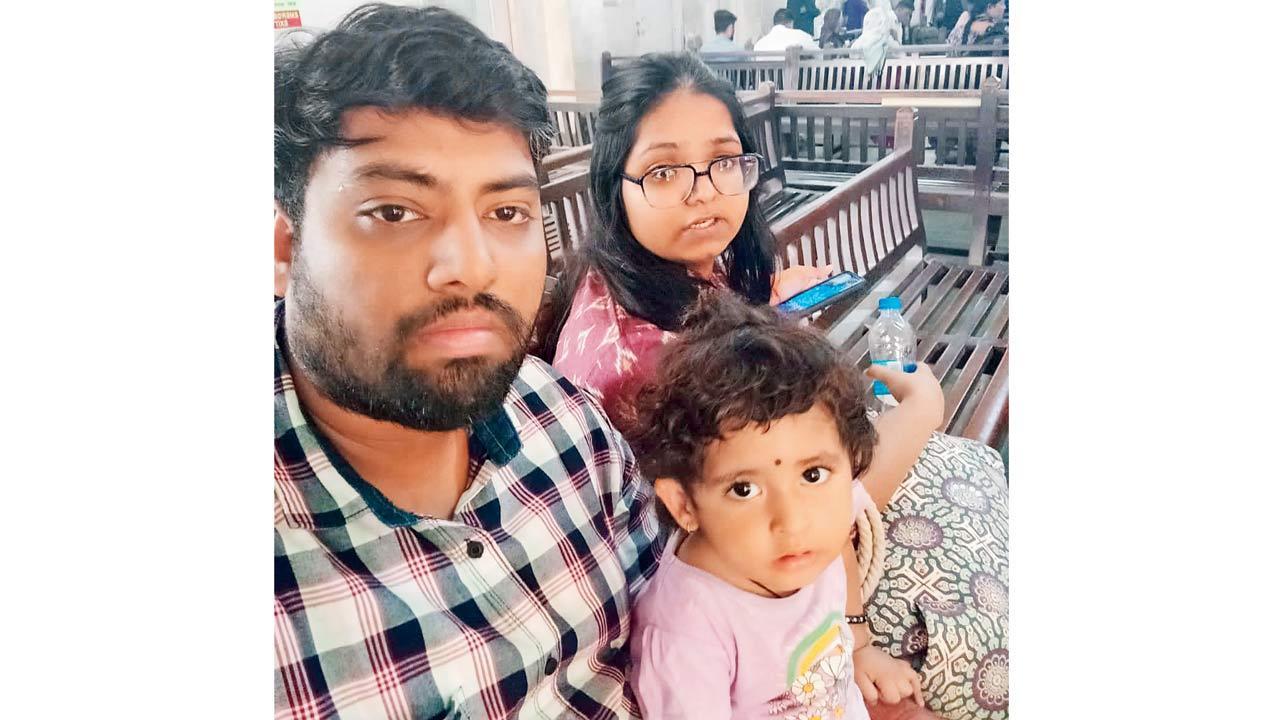

Ashish Singh, an architect and his wife Kirti, a CA with their daughter Aakriti, an SMA type 1 child at KEM Hospital recently

Parents of children with Spinal Muscular Atrophy (SMA), a rare disease, say the budget is mere eyewash. The custom duty exemption has existed for years, offering no real relief. The drugs are so expensive, costing crores, that only a few can afford them. Instead, the government should have given a GST exemption on SMA type 1 drugs available domestically, easing the financial burden but failed to address the struggles of SMA children and parents.

ADVERTISEMENT

mid-day has carried numerous articles highlighting the plight of parents, who are helpless and cannot afford the expensive drugs. In its recent article ‘Two-year-old has only 15 days of medicines left’, mid-day highlighted the plight of the parents, who were left in limbo following the Supreme Court's stay on a Delhi HC order allowing government aid.

A week left

“We have medicine for Aakriti, which can last for only a week. We have managed to save a little around R1 lakh-R2 lakh funds. We have reached out to NGOs and good Samaritans but have no concrete response yet. I guess there would be days where she would be without medicine,” says Ashish Singh, architect father of Aakriti, suffering from SMA type 1. Her parents are struggling to raise funds for her medication.

Improve drug accessibility

“Access to life-saving medicines should be a fundamental right, not a privilege. The government’s exemption of 36 critical drugs from basic customs duty and concessions on six others is a positive step but doesn’t make them truly affordable,” said Aakriti’s mother Kirti Singh, who is a chartered accountant. “GST exemptions apply only to imported medicines for personal use. Domestic ones face 12 per cent GST. Extending this exemption to all life-saving drugs would improve accessibility.”

Unaffordable pricing

“It is the state's constitutional responsibility to ensure the right to life under Article 21, and Article 47 mandates the improvement of public health as a primary duty. To uphold these principles, the government must not only expand tax exemptions but also introduce price regulations on life-saving drugs to ensure affordability,” said she said.

SMA parents disappointed

“Our main concern is that the government has not provided a GST exemption,” said Alpana Sharma, Co-founder and Trustee CureSMA India, and mother of a SMA child. “There is an urgent need for more effective policies and support systems to help families navigate the challenges of rare diseases like SMA. As rare diseases impact a minuscule population, we are not the vote banks and the pleas from helpless and hapless citizens like us are falling to deaf ears,” said Sharma.

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

Subscribe today by clicking the link and stay updated with the latest news!" Click here!

_d.jpg)